Expertises / Legal Structuring of International Investments

Legal Structuring of

International Investments

Facilitating global investments in Brazil from Luxembourg.

How to choose a jurisdiction?

We have 3 categories of jurisdictions to consider:

Tax Havens (0% tax) – Bahamas, Panama, British Virgin Islands and Cayman Islands.

Low tax jurisdictions (less than 10% tax) – Cyprus, Liechtenstein, Hong Kong, Uruguay and Malta.

Traditional jurisdictions, with tax exemptions for certain activities – Luxembourg, United Kingdom and Switzerland.

What factors to consider?

Political Stability

Economic Reputation

Legal Environment

Double Taxation Treaties

Service Infrastructure

Banking Sector

Why choose Luxembourg?

Luxembourg is the European hub for managing international investments: it is not a tax haven, has a solid banking system, a full range of service providers and English is the language of the business world.

It has a well-structured legal system, with a variety of flexible legal instruments, which enable the design of the best solution for each client, in addition to having a stable political, economic and regulatory system and an agreement to avoid double taxation with 84 countries (Brazil, USA, China, Switzerland).

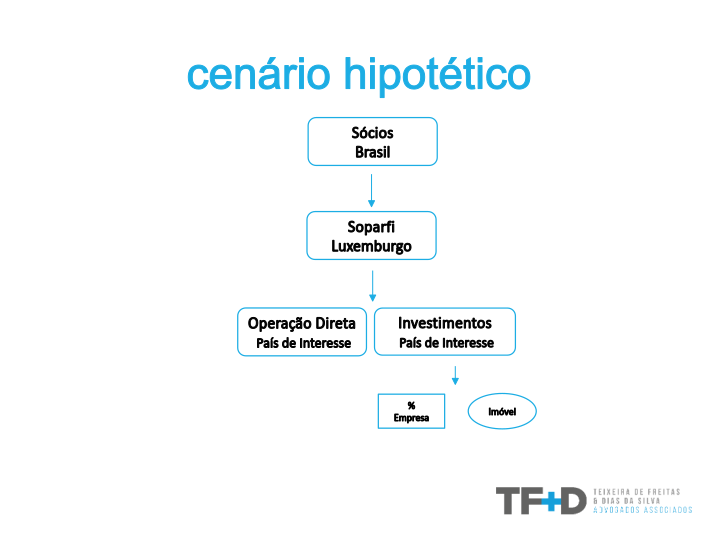

SOPARFI

SOciété de PARticipations FInanciéres

Financial holding company

Used for:

- exercise of corporate control;

- investments in real estate;

- group financial management.

Taxation of a SOPARFI

Income tax

A SOPARFI is eligible for the Participation Exemption regime, with exemption from income tax for receiving dividends or capital gains.

Wealth tax

Flat Fee of €4.815 per year.

Participation Exemption

Eligibility Requirements:

Branch tax status

Company subject to tax on profits in its country of residence, comparable to that in Luxembourg.

Minimum percentage

Minimum participation of 10%, or have an acquisition value of €1.2 million (for exemption on dividends) or €6 million (for exemption on capital gains).

Grace period

Continuous investment period of at least 12 months.