Expertises / Succession and Asset Planning

Succession and Asset Planning

Maximize your assets with us: tax structuring, planned success.

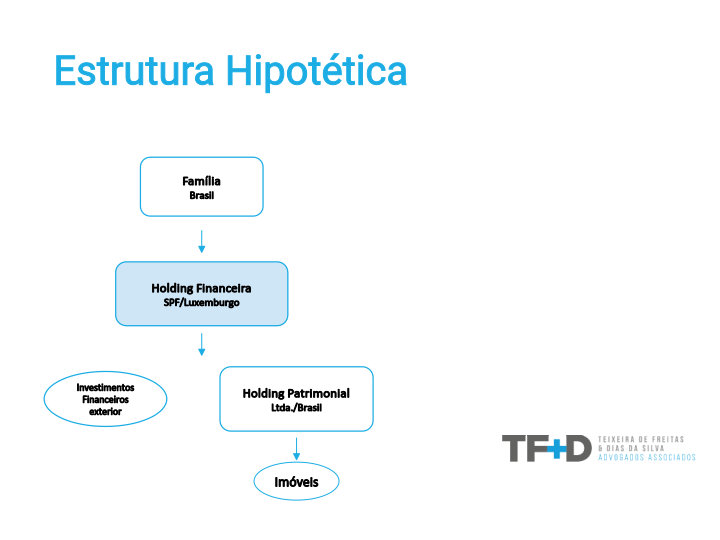

Family Wealth

Management Society

A Family Wealth Management Society is a limited liability company (Sàrl), in which all partners are natural persons, whose purpose is:

Permitted activities:

- Investments in financial instruments, in the broadest sense, including quotas/shares in other companies;

- Granting of loans.

Prohibited activities:

- Any type of commercial activity;

- Direct ownership of real estate;

- The holding of patents or rights.

SPF Taxation

Income and Wealth Tax

Full exemption

Subscription Fee

At the rate of 0.25% per year on equity

Step by step

Step 01 - Opening of the Society

Contribution of minimum share capital (€12.000) and Signature of the Deed of Incorporation.

01

Step 02 - Society Registration

Registration at the Luxembourg Commercial Board.

02

Step 03 - Foreign Investor

Obtaining a CNPJ from the Luxembourg company as a foreign investor.

03

Step 04 - Framework Integration

Entry into Luxembourg society within the membership of the Brazilian Patrimonial Holding.

04

Succession – Assets abroad

CF/88

Art. 155, § 1º:

III – will be competent for your institution regulated by complementary law:

a) if the donor is domiciled or resides abroad;

b) if the deceased had property, was resident or domiciled or had their inventory processed abroad.

a) if the donor is domiciled or resides abroad;

b) if the deceased had property, was resident or domiciled or had their inventory processed abroad.

STF – EXTRAORDINARY RESOURCE 851.108 SÃO PAULO

6. […]. Before the issuance of the aforementioned complementary law, the ITCMD requirement referred to in that article will be eliminated, since the states do not have the legislative competence in tax matters to make up for the absence of a national complementary law required by art. 155, § 1, item III, CF.