The Special Limited Partnership (SLP) in Luxembourg company law

Published on: October 27, 2023

1. Introduction

SLP has already been called a “legal UFO” since it does not have legal personality but has some of its attributes (assets, corporate name, headquarters, corporate bodies, among others).

The creation of the institute by Luxembourg law was based on the adoption of a legal tool with the same characteristics as the limited partnership of Anglo-Saxon Law, widely used by the investment fund industry, especially by the private equity fund industry, in which the The fund’s founder is the general partner and investors assume the role of limited partners, with clear segregation of business risk.

Two major advantages of this type of corporate vehicle are:

(a) the flexibility to adopt the rules that govern society, which are purely contractual in nature;

(b) fiscal transparency.

2. Flexibility

The creation of SLP takes place through the publication, together with the Luxembourg company register, of an extract from the constitutive act, containing: (i) the name of the general partners; (ii) the corporate name, (iii) the headquarters, (iv) the corporate purpose, (v) the managers, and (vi) the duration of the company.

The entire content of the articles of incorporation and the registration of all partners are private documents, filed only at the company’s registered office (except for the need to register the final beneficiaries, who hold more than 25% of the company, with the Luxembourg companies register) .

In this context, it is not mandatory:

(a) publication of the amount of share capital;

(b) the identity of the investing partners.

The social contract may freely provide for the conditions for admission and withdrawal of partners, the form in which the social contribution will be made, the periodicity and form of distribution of dividends, the creation of differentiated voting rights (such as multiple voting or veto rights). ), the transfer of shareholdings.

3. Fiscal transparency

SLP is fiscally transparent for income and wealth tax purposes. Furthermore, if the general partner does not hold more than 5% of the value of the shares and SCSp does not carry out any commercial activity, the company is also not subject to municipal tax.

Foreign investor partners (whatever their legal form) will not be subject to any tax in Luxembourg, nor will they have any additional obligations before the Luxembourg tax authorities.

4. The main uses of the vehicle

Aside from its wide use by the fund industry (UCI Part II, SIF, SICAR or RAIF), a SLP can also be considered as a suitable form of an indirect investment vehicle (feeder fund vehicle), created to accommodate investments by investors who a special legal or tax regime.

The contractual flexibility of the SLP regime and the private nature of its corporate agreements may also favor the use of a SLP as a co-investment vehicle in assets such as real estate projects, in which the main participant is the real estate developer.

Finally, due to its fiscal transparency, SLP can serve as the ideal choice of asset-owning entity. This is specifically relevant to joint ventures in the real estate and infrastructure sectors.

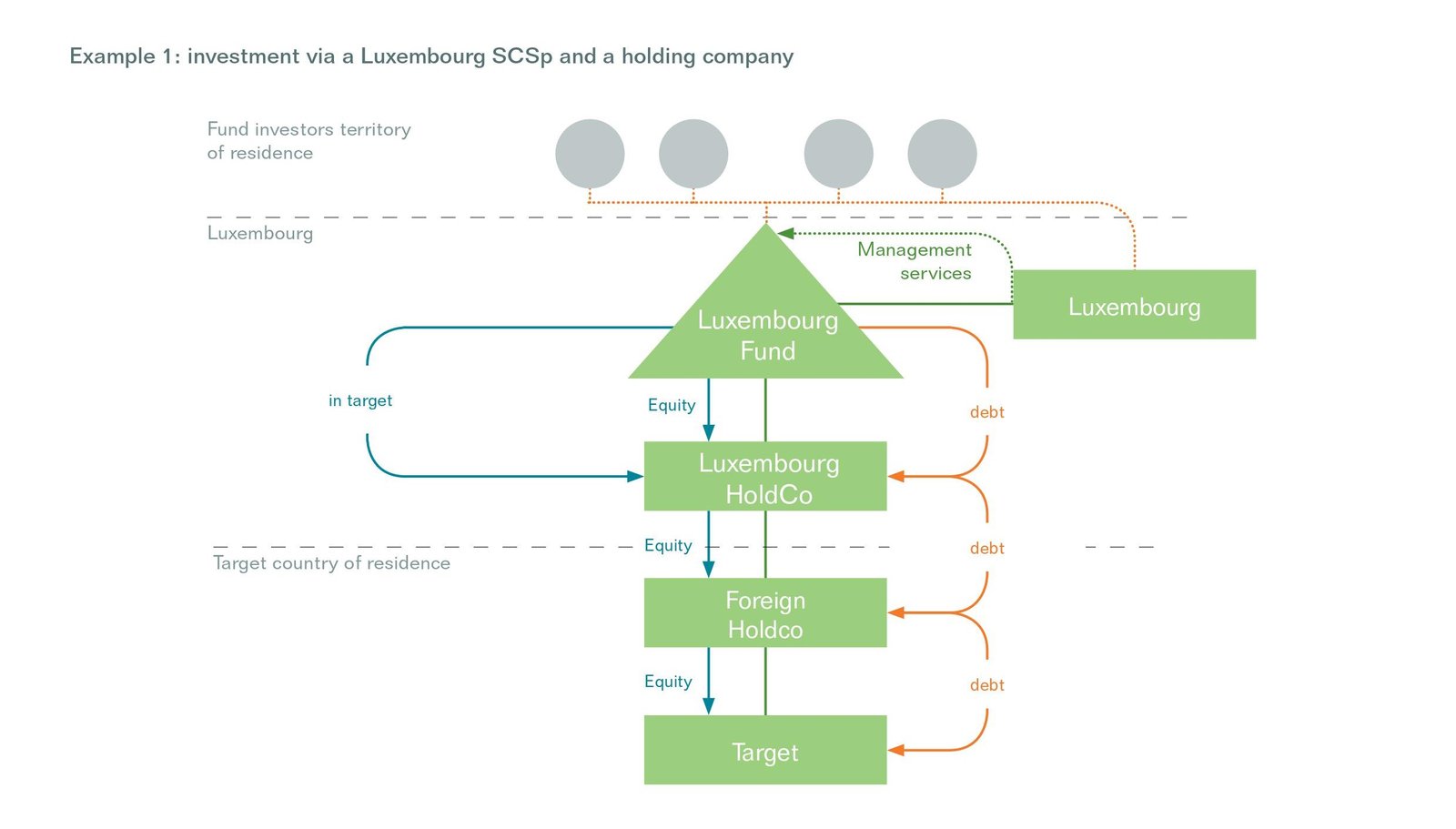

The Luxembourg Fund Industry Association, in the publication “Luxembourg Private Equity and Venture Capital”, exemplifies how SLP can be used to structure a real estate investment: